Indirect Tax Compliance

Indirect Tax Compliance:

The Goods and Services Tax (GST) is a tax on goods and services consumed in India. GST is an indirect tax that has replaced many other indirect taxes in India, such as excise duty, VAT, and services tax. GST has been in force from 1st July, 2017 based on the Goods and Service Tax Act passed by the Indian Parliament on March 29, 2017.

With the advent of GST, it has become necessary for the businesses to take assistance of expert services in the field and reduce impediments on account of compliances.

With a team of experts, we assist businesses for the by providing various services related to GST and other indirect taxes. Some of the services provided by us are:

- GST Registrations & Compliances

- GST Return Filing

- E-way Bill generation

- GST Annual Return filing

- GST Refund filing

- Representation before adjudication authority under GST laws

- Representation before adjudication authority under previous tax laws

- GST Registrations:

- Assisting in gathering and preparing all the necessary documents required for GST registration.

- Review process to minimize the chances of errors or delays in your application.

- Liaison with Authorities – Our experts engage with the relevant authorities on your behalf, ensuring that your application progresses smoothly through the registration process. Any queries or clarifications required by the authorities are promptly addressed

- Upon successful approval of your GST registration, we ensure that you receive your registration certificate promptly.

- GST Return Filing:

- Preparation and Filing of GST Returns.

- Output GST and Input Tax Credit Reconciliation with Books.

- Assisting in implementation and generating E-invoices.

- Providing guidance to identify the most appropriate HSN/SAC code for specific goods or services based on their inherent characteristics.

- E-way Bill generation:

- Supporting in the generation of e-way bill.

- Assistance in cancellation of the e-way bill.

- Understanding of exceptions to e-way bill generation.

- GST Annual Return filing:

- Review of data, returns, systems vis-à-vis Tax Laws.

- Review of Tax computation.

- Finalization of observation and discussion.

- Finalization of Reconciliation and Audit Report.

- GST Refund filing:

- Preparation and filing of refund claims

- Providing end to end support including liaising with the authorities and obtaining refund orders

- Representation before adjudication authority under GST laws and previous tax laws:

- Crafting well-structured responses to notices and drafting appeals.

- Drafting and filing applications for advance rulings.

- Skilled representation before revenue authorities at various levels.

- Conducting comprehensive litigation reviews to formulate strategies for prompt issue resolution.

- Representation before adjudication authority under previous tax laws:

Contacts US

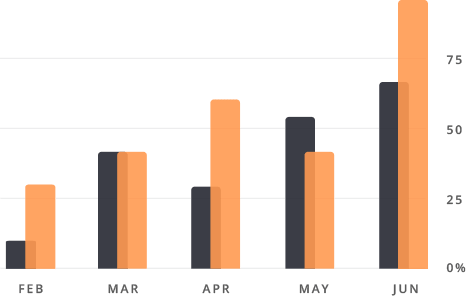

75

marketing analysis

65

business innovation

90

finance strategy

We are Always Ready to Assist Our Clients

developing financial processes and procedures

How It Works & How We Do It

Our specialists are ready to provide an analysis of both the market as a whole and its individual components (competitors, consumers, product, etc.), using practical methods and starting from your research goals.

- the organization is just beginning to operate in the market, implementing some projects. Our team of global experts help you achieve sustainable, organic growth by focusing on three critical building blocks.

- there are projects that require temporary expansion of the marketing department. Customer-focused businesses build a virtuous cycle we call the "customer wheel." We help you at every stage of growth, developing custom solutions and collaborating with all levels of your organization.

- there are projects that require temporary expansion of the marketing department. Align your marketing and brand strategy with overarching business objectives. We help you combine hard metrics with creative.

“I cannot give you the formula for success, but I can give you the formula for failure. It is: Try to please everybody.” david oswald

Business Planning & Strategy

Nurture promoters, your loyal customers who are more profitable and will advocate for your business—both in good times and bad.

Customer-focused businesses build a virtuous cycle we call the “customer wheel.” We help you at every stage of growth, developing custom solutions and collaborating with all levels of your organization. Identify quick, targeted customized solutions and operational improvements.

Contacts US

Contacts

Visit Us

806, Ecstasy Business Park, Beside Citi Of Joy, Mulund West, Mumbai – 400080

Have Any Questions?

022-25674108

Mail Us

team@vidwatadvisors.com

- Supporting in the generation of e-way bill.

- Assistance in cancellation of the e-way bill.

- Understanding of exceptions to e-way bill generation.