Equity and Debt Syndication

Corporate Financial Planning:

Corporate financial planning is a process that companies use to plan for short and long-term financial goals. Using the expertise in the area, we provide clients with the following services:

- Critical evaluation of the overall financial situation.

- Evaluation of the best Debt-Equity mix.

- Optimal resource allocation and decisions on investment opportunities.

- Fund flow management advisory.

Equity and Debt Syndication:

In today’s complex economic environment, organizations need services for various business reasons including funding for mergers, acquisitions, buyouts, other capital expenditure projects and for working capital reasons. Taking assistance of experts can help the organizations to navigate these challenges.

With the help of our team of experts, we provide our clients with the following services:

-

Debt structuring and advisory: Debt structuring is a critical aspect of financial management that involves strategically organizing debt instruments to suit your company's unique needs and goals.

Our team of seasoned professionals brings extensive expertise and industry insights to help you navigate the complexities of debt financing and secure the most favorable terms for your business. -

Assessment of project finance and working capital finance: Project Finance Services are designed to support your ambitions by offering strategic financial solutions to execute your ventures successfully. Whether you are initiating a new project or expanding existing operations, we work closely with you to structure the most appropriate financing package that aligns with your project's scale, risk profile, and cash flow projections. Our experts will guide you through the complexities of securing long-term debt, equity financing, and identifying suitable funding sources, ensuring your project gains the financial backing it deserves.

Our Working Capital Finance Services are tailored to address the specific cash flow requirements of your business. We offer a range of short-term financing options, such as trade finance, inventory funding, accounts receivable financing, and working capital loans, to ensure you have the necessary liquidity to meet operational expenses, manage inventory, and seize growth opportunities. Our experts work collaboratively with you to optimize your working capital management, supporting efficiency, and overall financial stability. - Syndicating and arranging Equity capital: Raising equity capital is a critical milestone for businesses looking to expand, invest in new projects, or execute strategic acquisitions. Our Syndicating and Arranging Equity Capital Services are designed to support your growth ambitions by connecting you with potential equity investors and guiding you through the capital-raising process. We assist you in structuring the most suitable equity financing package and preparing compelling investment proposals that resonate with investors.

- Arranging foreign currency loans and External Commercial Borrowings (ECBs): There is significance of accessing foreign currency funds to support your international ventures or capitalize on global market opportunities. Our Arranging Foreign Currency Loan and ECB services are designed to assist you in navigating the complexities of international financing, connecting you with reputable international lenders, and ensuring compliance with regulatory requirements.

Contacts US

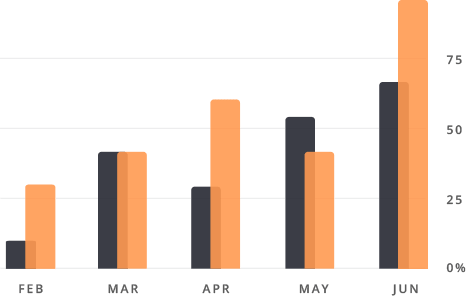

75

marketing analysis

65

business innovation

90

finance strategy

We are Always Ready to Assist Our Clients

developing financial processes and procedures

We are Always Ready to Assist Our Clients

developing financial processes and procedures

How It Works & How We Do It

Our specialists are ready to provide an analysis of both the market as a whole and its individual components (competitors, consumers, product, etc.), using practical methods and starting from your research goals.

- the organization is just beginning to operate in the market, implementing some projects. Our team of global experts help you achieve sustainable, organic growth by focusing on three critical building blocks.

- there are projects that require temporary expansion of the marketing department. Customer-focused businesses build a virtuous cycle we call the "customer wheel." We help you at every stage of growth, developing custom solutions and collaborating with all levels of your organization.

- there are projects that require temporary expansion of the marketing department. Align your marketing and brand strategy with overarching business objectives. We help you combine hard metrics with creative.

“I cannot give you the formula for success, but I can give you the formula for failure. It is: Try to please everybody.” david oswald

Business Planning & Strategy

Nurture promoters, your loyal customers who are more profitable and will advocate for your business—both in good times and bad.

Customer-focused businesses build a virtuous cycle we call the “customer wheel.” We help you at every stage of growth, developing custom solutions and collaborating with all levels of your organization. Identify quick, targeted customized solutions and operational improvements.

Contacts US

Contacts

Visit Us

806, Ecstasy Business Park, Beside Citi Of Joy, Mulund West, Mumbai – 400080

Have Any Questions?

022-25674108

Mail Us

team@vidwatadvisors.com